Water leaks, like silent predators, wreak havoc slowly but surely. They damage properties quietly and can cause a financial tumble if not addressed on time. But what’s even more surprising is that 24% of all insurance homeowners’ claims are related to water damage and freezing, according to the Insurance Information Institute.\

Success in claiming water leak insurance isn’t something that just occurs by chance. It’s a process steeped in careful documentation and timely actions. For example, The Institute of Inspection Cleaning and Restoration Certification suggests acting quickly because most insurance policies have a condition which mandates that homeowners must prevent further damage post-discovery. Therefore, arranging for temporary repairs, documenting damage, and informing your insurance company as soon as possible all contribute to a successful claim.

- Immediately contact your insurance company and report the water leak.

- Document the damage with photos or videos and list damaged items with their value.

- Make necessary repairs to stop further damage.

- Keep records of all related expenses.

- Submit your claim with all the evidence and documentation promptly.

Navigating a Successful Water Leak Insurance Claim

Understanding insurance claims for water damage can be complex and confusing. The following guide will shed light on how to make a successful water leak insurance claim. Because water leak-related damages can cause significant financial losses, it is crucial to equip yourself with the knowledge needed to maneuver through the claim’s process effectively.

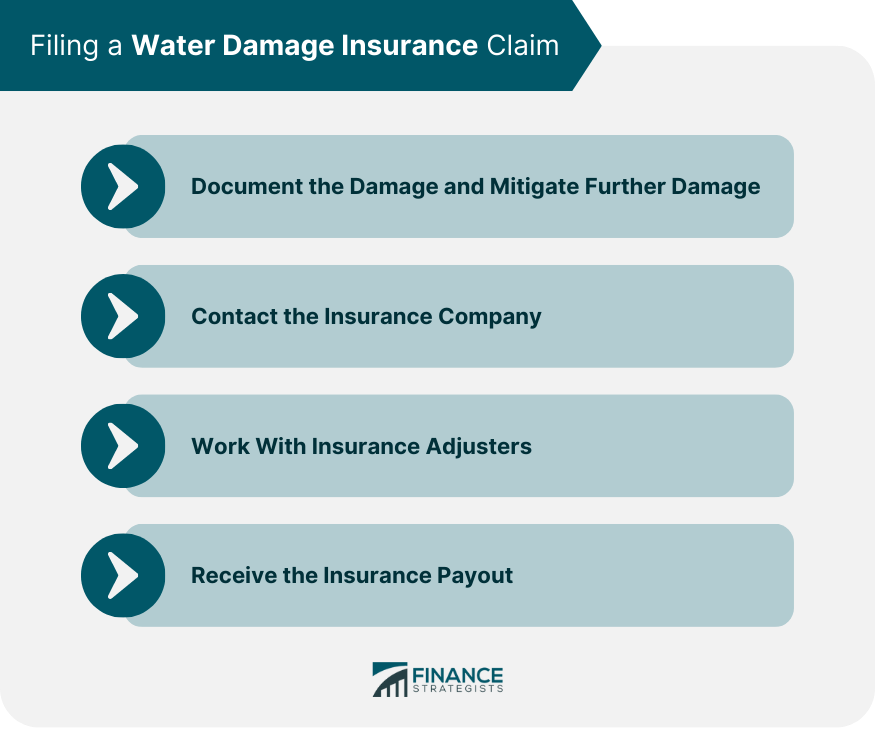

Source: financestrategists.com

Source: financestrategists.com

Identify The Source of Leak

Before initiating your water leak claim, understanding the type of leak and the resulting damage is vital. There are different types of water leaks, such as plumbing leaks, roof leaks, and slab leaks, and understanding these can determine whether your insurance will cover the damages or not. Always check your insurance policy to clarify what types of leaks are covered.

If the source of the leak is traced to negligence or lack of proper maintenance, the insurance company might deny the claim. On the other hand, claims due to sudden and accidental leakage are generally covered. Therefore, regular maintenance checks of all your property’s water systems can save you from unexpected denials of your water leak insurance claim.

In cases where the leak source is unknown, hiring a plumber or a professional leak detection service can help identify and document the leak source correctly. This will strengthen the credibility of your claim.

Remember, swift action plays a crucial role in mitigating the extent of water damage, reducing any additional costs, and increasing the chances of your claim being accepted.

Notify your Insurance Company Immediately

It’s essential to notify your insurance company immediately after noticing a leak. This helps them assess whether the damages are indeed accidental and not due to negligence or deliberate actions. Most insurance companies have strict timelines for reporting claims, usually within 14 days of the incident. Any delay can lead to the reduction or outright denial of your claim.

When contacting the insurer, be sure to provide all necessary details – your policy number, a brief description of what happened, and the extent of the damage. This immediate report serves as your ‘proof of loss’ documentation. Ensure you document this conversation in case you need to reference it in the future.

Remember to follow up the call with a written notification. Make sure you send it via certified mail. This becomes part of your documentation and validates the timeliness of your claim.

Document The Leakage and Damages

To prove the validity of your claim, assuming the role of a de facto investigator is a wise move. Documenting every aspect of the leak, including the source, progression, impact, and resulting damage, is invaluable. Take clear photographs and videos of visible leaks, damaged assets, structural damage and any other evidence that will substantiate your claim.

Moreover, make a detailed inventory of affected personal property. This list should include the name, model, purchase date, original cost, and estimated replacement cost of each damaged item. Include photographs of these items along with their purchase receipts, if possible.

Refrain from any urge to discard damaged items before the adjuster’s visit. They are critical proof for your claim. However, if there are safety concerns, ensure to save samples of the destroyed materials.

Managing the Aftermath

Armed with the knowledge of how to handle the immediate concerns when facing a water leak claim, let’s explore how to manage the aftermath and ensure you achieve a successful water leak insurance claim. For clarity, we will cover topics such as understanding what to expect from an adjuster’s visit, how to review your claim settlements, and why getting professional assistance might be beneficial.

Understanding The Adjuster’s Visit

When you file a claim, an insurance adjuster visits your property to inspect the damages and determine the extent of coverage. It’s crucial to be well-prepared for this visit. Familiarize yourself thoroughly with your insurance policy, particularly the sections relating to water leaks. Take your adjuster through the damages, using your documentation as the basis for discussion. This would help clarify any discrepancies right at the onset.

During this visit, the adjuster will also evaluate the overall condition of your home. They can assert that existing structural or maintenance issues contributed to the leak and the ensuing damage. So, keeping your home in good general repair can save you from undesirable claim reductions.

While assisting your adjuster, be clear, concise, and accurate in your explanations. Do not exaggerate the damages, as this can lead to suspicion, further investigation, and possible denial of your claim. Record the entire visit, keeping notes and clarifications. This information could be instrumental in case of any dispute arising from the claim.

It’s important to remember that adjusters work on behalf of the insurance company, and their goal is to minimize claim payouts. Therefore, be attentive, review the adjuster’s report thoroughly and dispute any inaccuracies immediately.

Reviewing Your Insurance Settlement

After the adjuster’s visit, the insurance company will offer you a settlement based on the report provided by the adjuster. It’s critical to thoroughly dissect this report to ensure that it accurately represents your documented damages and claims. Make sure that it includes all necessary repairs, replacements, and professional services like cleaning and disinfection to restore your property to its pre-leak condition.

If you identify any discrepancies, do not hesitate to raise these with the insurance company. Keep all your communications written, clear, and concise. Challenge the proposed settlement if it falls short of your claim, providing clarified reasons and additional proof where necessary.

While negotiating, always leverage your policy’s maximum payout limit. Remember that initial settlements are rarely the insurer’s final offers. So, remain assertive and persistent to attain a favorable outcome.

Getting Professional Assistance

Professional assistance can help ease the process of making a successful water leak insurance claim. Hiring a public adjuster can come in handy, especially if the claim process becomes contentious. These professionals advocate for the policyholder in appraising and negotiating an insurance claim. Their expertise can help you get back on your feet faster after a water leak disaster.

Legal professionals also provide valuable support, particularly when you believe your insurer isn’t honoring the terms of your policy or fails to perform in good faith. They can help negotiate a more favorable settlement and can represent you should you choose to take legal action against your insurer.

Lastly, service providers like contractors and restoration companies can provide written estimates to assist with proving the value of your claim. They can also help determine if the insurer’s proposed compensation properly addresses all the issues and meets all repair and replacement costs.

Your battle doesn’t end with submitting the claim; it’s a continuous process that involves persistently tracking the status of your claim, following up regularly, and ensuring all your concerns are addressed promptly. A proactive approach, proper documentation, timely communication, and strategic negotiations are key to securing a successful claim. Remember that your focus is not just on reimbursing the loss, but restoring your home to its pre-leak condition.

How to make a successful water leak insurance claim

Strategies for a Successful Water Leak Insurance Claim

Dealing with a water leak can be devastating, but a successful insurance claim can aid in recovery. Here are some strategies to optimize your claim.

- Documentation is the key. Take photos or videos of the damage immediately and keep a detailed journal of the progression of the issues.

- Get professional water damage inspection carried out. This will serve as proof of the severity of the issue.

- Inform your insurance company as soon as possible. They may require you to take certain steps within a given timeframe to ensure your claim remains valid.

- Keep records of all communication, expenses, and actions taken during the recovery process to support your claim.

- Understand the terms of your policy. Some insurers do not cover certain types of water leak damage. If required, get a public adjuster to negotiate on your behalf.

###

Key Takeaways

- Understand your insurance policy coverage related to water leaks.

- Quick response to water leaks is pivotal for a successful claim.

- Documentation is key; Photograph every damage detail thoroughly.

- Employ a professional for an accurate property damage estimate.

- Seek guidance from experienced insurance claim experts.

###

Frequently Asked Questions

Understanding the nuances of making a successful water leak insurance claim is vital. Here are a few commonly asked questions that provide a deeper insight into this process.

1. How can I prepare for filing a water damage insurance claim?

Preparation is crucial when proceeding to make a water damage insurance claim. Start by documenting the damage – take clear, detailed photographs and videos that highlight the areas affected by the leak. Do this before carrying out any initial clean-up activities as it provides indisputable evidence of the damage.

It’s also a good idea to have an inventory of your possessions. This list can prove invaluable when claiming for items damaged by the water leak. Also, ensure to review your insurance policy thoroughly to know exactly what is covered and what isn’t, this would help to avoid any stumbling blocks down the line.

2. What mistakes should I avoid when making a water leak insurance claim?

Making a successful water leak insurance claim requires prudence and accuracy. One common mistake is not notifying your insurance company promptly after discovering the water damage. A delay might raise suspicions about the validity of your claim. Additionally, avoid doing extensive repairs before the insurance adjuster visits. They need to visually assess the damage, and if it’s already fixed, this could potentially invalidate your claim.

Another fatal mistake is underestimating the extent of damage. When filing the claim, it is essential to document every detail, including minor damages. Overlooking small points can jeopardize the overall success of your claim. Lastly, try not to settle for the first offer from the insurance company. If it doesn’t cover all your documented damages, don’t hesitate to argue your case.

3. Can professional water damage restoration services assist in making a claim?

Absolutely. Professional water damage restoration services can be a great asset when making a water leak insurance claim. These experts are familiar with the claims process and can help document the damage in detail, often noting things you may miss. Their detailed reports can fortify your claim, making it harder for the insurance company to dispute the extent of the water damage.

Furthermore, many restoration companies can directly bill your insurance, simplifying the claims process for you. Their licenses and certifications also lend credibility to their evaluations and estimates. Just be sure to choose a reputable service that has a history of successful insurance dealings.

4. Do insurance policies always cover water leaks?

No, not all insurance policies may cover water leaks. The coverage for water damage can vary greatly from one policy to another. Typically, standard home insurance policies cover sudden and accidental water damage—like a burst pipe. However, damage resulting from a lack of proper maintenance may not be included in your coverage.

Also, certain types of water-related damage, such as from floods or sewer backups, generally require additional specific coverage. Therefore, it’s crucial to thoroughly review and understand the terms and conditions of your insurance policy. When in doubt, confer with your insurance agent to clarify what your specific policy covers.

5. What should I expect during the water leak insurance claim process?

Firstly, you should expect to have the damage inspected by an adjuster from your insurance company. This adjuster’s report is crucial to the claims process as it determines how much compensation you may receive. During the adjuster’s visit, it might be helpful to have any documentation, receipts, photos, videos, etc., easily accessible.

Once you’ve submitted the claim, there could be some back-and-forth with the insurance company as they may need additional evidence or information. Additionally, the compensation process could take time, anywhere from weeks to months. While claim processing times vary based on the insurer and complexity of the claim, staying proactive and organized can speed up the procedure and help you get your claim settled faster.

How to Make a Successful Water Leak Insurance Claim (Everything Explained)

Mastering the art of forming a strong water leak insurance claim isn’t all Greek. Don’t forget, step one, act fast! The sooner you make contact with your insurance, the better. Double-check your policy, have evidence at hand, and keep all those repairs receipts. Summon the inner Sherlock Holmes in you and document every tiny detail!

Ready to roll now? Don’t shy away in asking help whenever needed, be it a public adjuster or a trusted contractor, go with your gut feeling. Communicate with your insurer, explain your whole scenario, and give them a walkthrough of your loss journey. Be patient, be assertive, and voila one fine day, you’ll surely crack the successful water leak insurance claim puzzle.